36+ how much should i spend on mortgage

Web We calculated how the 28 rule works out for various incomes. Web The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

How Much House Can You Afford

The cost of the loan.

. Ad See how much house you can afford. Web Beyond the Rule of 28 your overall debt-to-income ratio DTI shouldnt exceed 36. Save Real Money Today.

Going by the 28 percent rule. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Calculate Your Mortgage Payments With Our Free Mortgage Calculator Now.

Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and no. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. The mandatory insurance to protect your lenders investment of 80 or more of the homes value.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. The amount of money you borrowed. Web Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget.

Find The Right Mortgage For You By Shopping Multiple Lenders. Web So how much should you spend on monthly repayments. It Pays To Compare Offers.

Ad Calculate Your Monthly Payment with Our Free Online Mortgage Calculator. The monthly cost of property taxes HOA dues and homeowners insurance. Ways to Calculate How Much House You Can Afford Mortgage lenders may run your financials through a few different calculations when determining how much house you can afford based on income.

Web This rule also says that you should keep all of your household debt under 36 of your gross monthly income. Estimate your monthly mortgage payment. The rule of thumb states that your monthly mortgage payment shouldnt exceed 1680 6000 x 28 and that your total monthly debt payments including housing shouldnt exceed 2160 6000 x 36.

Web Lets say you earn 6000 a month before taxes or other deductions from your paycheck. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just 2900.

The 36 should include your monthly mortgage payment. If the borrowers make a down payment of less than 20 they will be required to pay private mortgage insurance PMI. Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000.

Web For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the. If you have one of the incomes below heres the maximum you should spend on a house. Estimate your monthly mortgage payment.

Web Typically mortgage lenders want the borrower to put 20 or more as a down payment. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. In some cases borrowers may put down as low as 3.

Yet the average married couple with children. Ad See how much house you can afford. Ad Calculate Your Monthly Payment with Our Free Online Mortgage Calculator.

Web The traditional monthly mortgage payment calculation includes. Web An old standard the 2836 rule says that your mortgage payment shouldnt be more than 28 of your monthly gross income and 36 of your total debt. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

That includes your mortgage credit card payments car loans and student loans. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. But our chase home affordability calculator can help refine and tailor the estimate of how much house you can afford based on additional factors.

Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you. Some experts have suggested something called the 2836 rule. Calculate Your Mortgage Payments With Our Free Mortgage Calculator Now.

This refers to the recommendation that.

:max_bytes(150000):strip_icc()/HowMuchMortgage-ad8d208596ba4eecb7c833bbcfa5b87d.jpeg)

How Much Should You Spend On A Mortgage

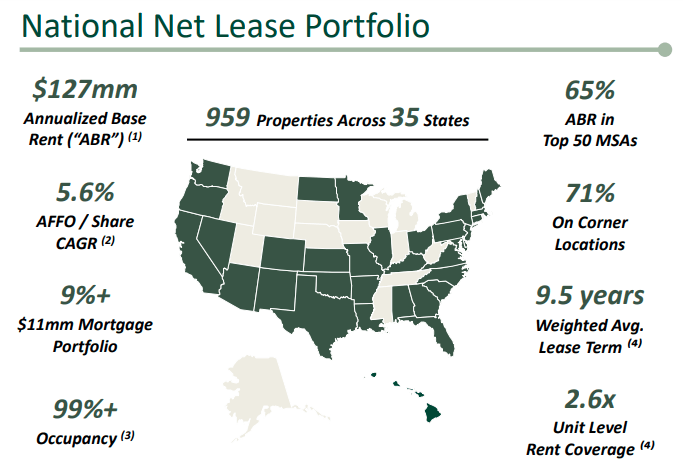

Getty Realty World Of Evs Will Require Far Fewer Gas Stations Nyse Gty Seeking Alpha

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Calameo November 2022 Business Examiner Vancouver Island

How Much House Can I Afford Smartasset

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

How Much House Can You Afford

How Much House Can I Afford Moneyunder30

Generating Lasting Wealth Springerlink

![]()

How Much House Can I Afford Interest Com

Income To Mortgage Ratio What Should Yours Be Moneyunder30

:max_bytes(150000):strip_icc()/avoiding-bad-home-layout-1798346_final-92e4aab4fe7d4913ac1493d24fc8267f.png)

What Is The 28 36 Rule Of Thumb For Mortgages

House Update Supposedly Dave Did All The Rest Of The Ceiling Scraping Sanding And Painting Did He Skim Coat At All Prime Or Just Paint Over The Old Drywall Also Has She Said

Paying Off A Mortgage Early How To Do It And Pros Cons

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

How Much House Can I Afford The Motley Fool

Mortgage Broker Facebook Advertising Case Study